Discoveries And Insights With Credit Strong App

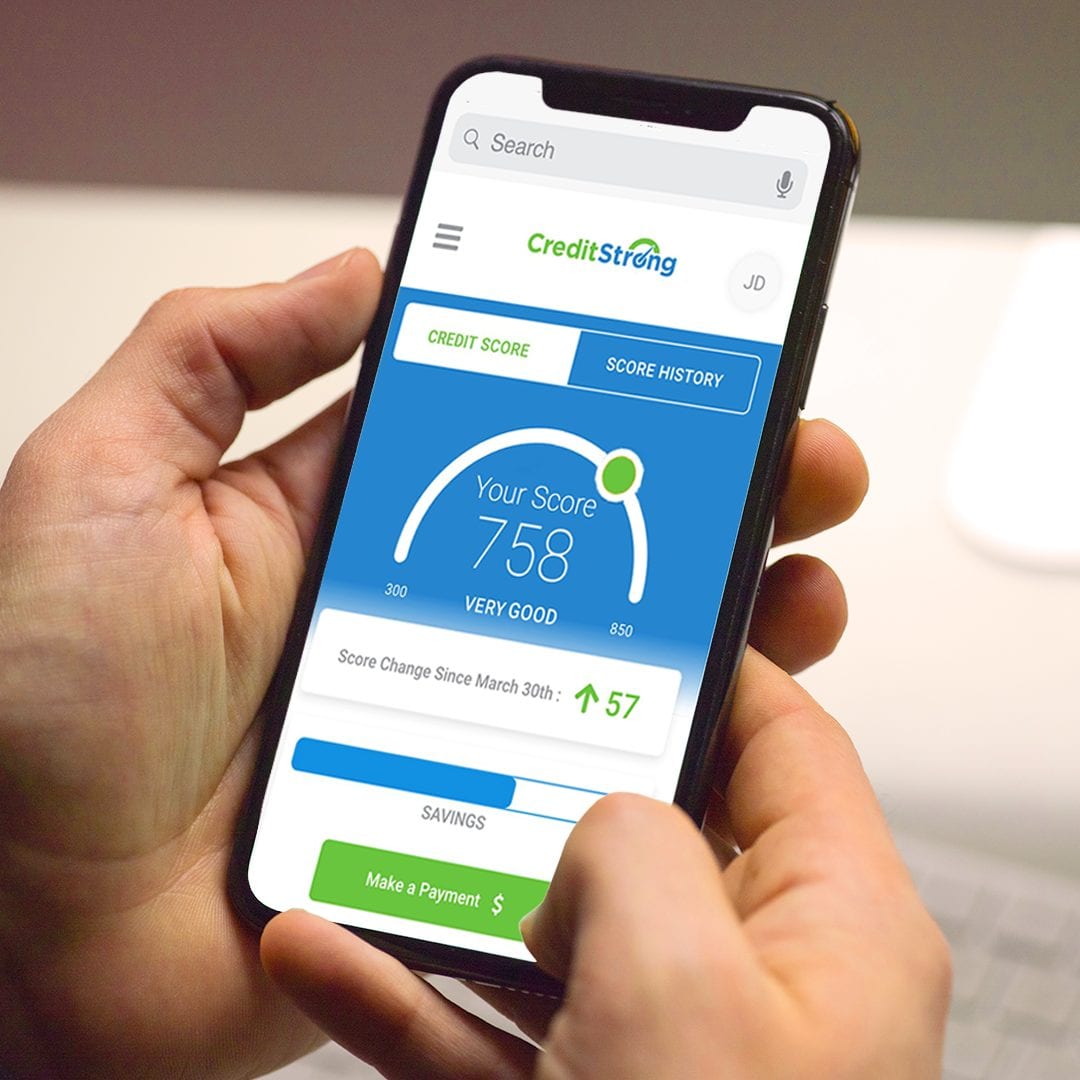

Credit Strong App is a mobile application that helps users improve their credit scores. It provides users with personalized recommendations on how to manage their credit, including tips on paying down debt, reducing credit utilization, and disputing errors on their credit reports.

Credit Strong App can be a valuable tool for anyone who wants to improve their credit score. By following the app's recommendations, users can save money on interest payments, qualify for better loan rates, and achieve their financial goals faster.

In addition to providing personalized recommendations, Credit Strong App also offers a number of other features, including:

- Credit monitoring: Users can track their credit scores and receive alerts when there are changes.

- Identity theft protection: Users can protect their personal information from identity thieves.

- Financial planning: Users can create budgets, track their spending, and set financial goals.

Credit Strong App

Credit Strong App is a mobile application that helps users improve their credit scores. It provides users with personalized recommendations on how to manage their credit, including tips on paying down debt, reducing credit utilization, and disputing errors on their credit reports.

- Credit monitoring: Users can track their credit scores and receive alerts when there are changes.

- Identity theft protection: Users can protect their personal information from identity thieves.

- Financial planning: Users can create budgets, track their spending, and set financial goals.

- Credit education: Users can learn about credit scores, credit reports, and how to improve their credit.

- Community support: Users can connect with other users who are working to improve their credit.

- Personalized recommendations: Users receive tailored advice on how to improve their credit based on their individual circumstances.

- Actionable steps: Users are provided with specific steps they can take to improve their credit.

- Easy to use: The app is user-friendly and easy to navigate.

- Affordable: The app is affordable and offers a free trial.

- Trusted: The app is backed by a team of credit experts.

These are just a few of the key aspects of Credit Strong App. By using the app, users can take control of their credit and achieve their financial goals.

Credit monitoring

Credit monitoring is an important part of managing your credit health. By tracking your credit scores and receiving alerts when there are changes, you can stay on top of your credit and take steps to improve it if necessary.

- Early detection of errors: Credit monitoring can help you detect errors on your credit report early on. This is important because errors can negatively impact your credit score. By disputing errors promptly, you can get them corrected and improve your credit score.

- Identity theft protection: Credit monitoring can also help you protect your identity from theft. If someone opens a fraudulent account in your name, you will be alerted so that you can take steps to protect your credit.

- Peace of mind: Knowing that you are monitoring your credit can give you peace of mind. You will know that you are taking steps to protect your credit and that you will be alerted if there are any changes.

Credit Strong App makes it easy to monitor your credit. The app provides you with a free credit score and credit report, and it sends you alerts when there are any changes to your credit. You can also use the app to dispute errors on your credit report and to protect your identity from theft.

Identity theft protection

Identity theft is a serious crime that can have a devastating impact on your finances and your life. Identity thieves can use your personal information to open new accounts, run up debts, and even commit fraud. Credit Strong App can help you protect your identity from theft by providing you with a number of features, including:

- ID Theft Monitoring: Credit Strong App monitors your credit reports and alerts you to any suspicious activity. This can help you detect identity theft early on, before it can cause serious damage.

- Identity Theft Insurance: Credit Strong App offers identity theft insurance that can help you recover from the financial losses associated with identity theft.

- Identity Theft Resolution Services: Credit Strong App provides you with access to a team of experts who can help you resolve identity theft issues.

By using Credit Strong App, you can take steps to protect your identity from theft and minimize the risk of financial loss.

Financial planning

Financial planning is an essential part of managing your credit and achieving your financial goals. By creating a budget, you can track your income and expenses, and make sure that you are living within your means. This can help you avoid debt and improve your credit score.

Credit Strong App can help you with financial planning by providing you with a number of tools and features, including:

- Budgeting tools: Credit Strong App provides you with a variety of budgeting tools to help you create and track your budget.

- Spending tracker: Credit Strong App allows you to track your spending so that you can see where your money is going.

- Goal setting: Credit Strong App helps you set financial goals and track your progress towards achieving them.

By using Credit Strong App, you can take control of your finances and achieve your financial goals. Financial planning is an important part of managing your credit and building a strong financial future.

Credit education

Credit education is an essential part of improving your credit and achieving your financial goals. By learning about credit scores, credit reports, and how to improve your credit, you can make informed decisions about your finances and avoid costly mistakes. Credit Strong App can help you with credit education by providing you with a number of resources, including:

- Credit Score Simulator: Credit Strong App's Credit Score Simulator allows you to see how different actions, such as paying down debt or disputing errors on your credit report, can impact your credit score.

- Credit Report Guide: Credit Strong App's Credit Report Guide provides you with a detailed explanation of credit reports, including what information is included on a credit report and how to read a credit report.

- Credit Improvement Tips: Credit Strong App provides you with a number of tips and resources to help you improve your credit, including tips on paying down debt, reducing credit utilization, and disputing errors on your credit report.

By using Credit Strong App, you can learn about credit scores, credit reports, and how to improve your credit. This knowledge can help you make informed decisions about your finances and achieve your financial goals.

Community support

Credit Strong App provides a community forum where users can connect with other users who are working to improve their credit. This can be a valuable resource for users, as they can share tips and advice, and support each other through the process of improving their credit.

There are a number of benefits to having community support when trying to improve your credit. First, it can help you stay motivated. When you see other people who are working towards the same goal, it can help you stay on track and avoid giving up. Second, community support can provide you with valuable information and advice. Other users may have experience with different credit repair techniques, and they can share their knowledge with you. Finally, community support can provide you with emotional support. When you are struggling to improve your credit, it can be helpful to talk to others who are going through the same thing.

Credit Strong App's community forum is a safe and supportive environment where users can connect with each other and share their experiences. The forum is moderated by a team of experts who can provide guidance and support to users. If you are looking to improve your credit, Credit Strong App's community forum can be a valuable resource.

Personalized recommendations

Credit Strong App provides users with personalized recommendations on how to improve their credit based on their individual circumstances. This is a key component of the app's effectiveness, as it allows users to get specific advice on the actions they can take to improve their credit score. For example, a user with a high credit utilization ratio may be advised to focus on paying down debt, while a user with a thin credit file may be advised to open a new line of credit and use it responsibly.

The personalized recommendations provided by Credit Strong App are based on a variety of factors, including the user's credit score, credit report, and financial history. The app's algorithm analyzes this data to identify the areas where the user can most effectively improve their credit. This tailored approach ensures that users get the most relevant and actionable advice possible.

The practical significance of this understanding is that it allows users to improve their credit score more quickly and efficiently. By following the personalized recommendations provided by Credit Strong App, users can avoid wasting time and effort on ineffective strategies. This can save users money on interest payments and help them achieve their financial goals faster.

Actionable steps

The Credit Strong App provides users with actionable steps they can take to improve their credit. This is a key component of the app's effectiveness, as it allows users to get specific advice on the actions they can take to improve their credit score. For example, a user with a high credit utilization ratio may be advised to focus on paying down debt, while a user with a thin credit file may be advised to open a new line of credit and use it responsibly.

The actionable steps provided by the Credit Strong App are based on a variety of factors, including the user's credit score, credit report, and financial history. The app's algorithm analyzes this data to identify the areas where the user can most effectively improve their credit. This tailored approach ensures that users get the most relevant and actionable advice possible.

The practical significance of this understanding is that it allows users to improve their credit score more quickly and efficiently. By following the actionable steps provided by the Credit Strong App, users can avoid wasting time and effort on ineffective strategies. This can save users money on interest payments and help them achieve their financial goals faster.

Easy to use

The Credit Strong App is designed to be easy to use, with a user-friendly interface and simple navigation. This is important because it makes the app accessible to users of all ages and technical abilities. Even users who are not familiar with financial apps can easily find their way around the Credit Strong App and get the information they need.

The app's ease of use is a key component of its effectiveness. When users can easily access and understand the information they need, they are more likely to take action to improve their credit. For example, the app provides users with personalized recommendations on how to improve their credit score. These recommendations are based on the user's individual credit situation, and they are presented in a clear and concise way. This makes it easy for users to understand what they need to do to improve their credit.

The Credit Strong App is a valuable tool for anyone who wants to improve their credit score. The app's ease of use makes it accessible to users of all ages and technical abilities, and its personalized recommendations can help users take action to improve their credit.

Affordable

The affordability of the Credit Strong App and its free trial offer make it accessible to a wide range of users. This is important because credit-related issues can disproportionately affect low-income and underserved populations. By providing an affordable and accessible solution, the Credit Strong App empowers these individuals to take control of their financial well-being.

- Financial Empowerment: The app's affordability enables users from all socioeconomic backgrounds to access credit-building tools and resources. This promotes financial inclusion and empowers individuals to improve their creditworthiness.

- Reduced Barriers to Entry: The free trial eliminates cost as a barrier to entry, allowing users to experience the app's benefits before committing to a subscription. This reduces the risk associated with trying a new financial service.

- Long-Term Savings: By improving their credit scores, users can qualify for lower interest rates on loans and other forms of credit. These savings can accumulate over time, leading to significant financial benefits.

- Improved Financial Health: Access to affordable credit-building tools can help individuals break the cycle of debt and improve their overall financial health. This can have a positive impact on their quality of life and long-term financial security.

The Credit Strong App's affordability and free trial offer make it a valuable tool for anyone looking to improve their credit and achieve their financial goals. By removing financial barriers and providing accessible resources, the app empowers users to take control of their financial well-being and build a stronger financial future.

Trusted

The fact that the Credit Strong App is backed by a team of credit experts is a key component of its trustworthiness and effectiveness. Credit repair and credit building can be complex processes, and having access to expert guidance can make all the difference. The team behind the Credit Strong App has decades of experience in the credit industry, and they are committed to helping users improve their credit scores and achieve their financial goals.

One of the most important things that the Credit Strong App's team of experts does is provide personalized recommendations to users. These recommendations are based on the user's individual credit situation, and they can help users identify the most effective ways to improve their credit scores. For example, a user with a high credit utilization ratio may be advised to focus on paying down debt, while a user with a thin credit file may be advised to open a new line of credit and use it responsibly.

The Credit Strong App's team of experts is also available to answer users' questions and provide support throughout the credit repair process. This is a valuable resource for users, as it can help them avoid costly mistakes and stay on track towards their goals.

Overall, the fact that the Credit Strong App is backed by a team of credit experts is a key reason why it is such an effective tool for improving credit scores. Users can trust that they are getting the best possible advice and support, and this can help them achieve their financial goals faster.

FAQs about Credit Strong App

This section provides answers to frequently asked questions about the Credit Strong App, a mobile application designed to help users improve their credit scores. These questions address common concerns or misconceptions about the app and its effectiveness.

Question 1: What is Credit Strong App and how does it work?

Credit Strong App is a mobile application that uses advanced algorithms and a team of credit experts to analyze users' credit reports and provide personalized recommendations on how to improve their credit scores. The app offers a range of features, including credit monitoring, identity theft protection, and financial planning tools.

Question 2: Is Credit Strong App legitimate?

Yes, Credit Strong App is a legitimate and reputable company. The app is backed by a team of credit experts with decades of experience in the credit industry. Credit Strong App uses secure encryption technology to protect users' personal and financial information.

Question 3: How much does Credit Strong App cost?

Credit Strong App offers a free trial period, after which users can choose from a variety of subscription plans. The cost of these plans varies depending on the features and services included. Credit Strong App also offers discounts for multiple subscriptions and extended subscription periods.

Question 4: Can Credit Strong App help me improve my credit score quickly?

While Credit Strong App can provide users with valuable tools and guidance to improve their credit scores, the speed at which a user's credit score improves will vary depending on a number of factors, such as their credit history, the severity of any negative items on their credit report, and their ability to follow the app's recommendations. Credit Strong App is designed to help users make sustainable improvements to their credit over time.

Question 5: Is Credit Strong App safe to use?

Yes, Credit Strong App is safe to use. The app uses secure encryption technology to protect users' personal and financial information. Credit Strong App is also committed to protecting users' privacy and does not share their information with third parties.

Question 6: What are the benefits of using Credit Strong App?

Credit Strong App offers a range of benefits, including:

- Personalized credit recommendations

- Credit monitoring and alerts

- Identity theft protection

- Financial planning tools

- Access to credit experts

By using Credit Strong App, users can take control of their credit and improve their financial health.

These are just a few of the most frequently asked questions about Credit Strong App. For more information, please visit the app's website or contact their customer support team.

In addition to the FAQs, Credit Strong App also provides a wealth of resources on its website, including articles, blog posts, and videos on a variety of credit-related topics. These resources can help users learn more about credit scores, credit reports, and how to improve their financial health.

Overall, Credit Strong App is a valuable tool for anyone looking to improve their credit score and take control of their financial future.

Tips to Improve Your Credit Score with Credit Strong App

Maintaining a good credit score is crucial for financial well-being. Credit Strong App offers a comprehensive suite of tools to help you monitor, manage, and improve your credit score. Here are some tips to maximize the benefits of using the app:

Tip 1: Track Your Credit Regularly

Regularly monitoring your credit report allows you to stay informed about its contents, identify any errors, and track your progress over time. Credit Strong App provides real-time credit monitoring, notifying you of any changes to your credit report.

Tip 2: Dispute Errors Promptly

Errors on your credit report can negatively impact your score. Credit Strong App makes it easy to dispute errors directly through the app. By addressing inaccuracies promptly, you can maintain the accuracy of your credit report.

Tip 3: Reduce Credit Utilization

Keeping your credit utilization ratio low is essential for a good credit score. Credit Strong App provides personalized recommendations on how to reduce your credit utilization, such as paying down debt or increasing your credit limits.

Tip 4: Build Positive Payment History

Making on-time payments is crucial for building a strong credit history. Credit Strong App offers reminders and payment tracking features to help you avoid missed payments and maintain a positive payment record.

Tip 5: Limit New Credit Applications

Applying for multiple new lines of credit in a short period can harm your credit score. Credit Strong App helps you understand the potential impact of new credit applications and guides you in making informed decisions.

Tip 6: Seek Professional Advice

If you encounter challenges in improving your credit score, consider seeking professional guidance. Credit Strong App provides access to a team of credit experts who can analyze your credit report and offer personalized advice.

Summary:

By following these tips and utilizing the features of Credit Strong App, you can effectively monitor, manage, and improve your credit score. Remember, building a strong credit history takes time and consistent effort. Credit Strong App empowers you with the tools and knowledge to achieve your credit goals.

Conclusion

In conclusion, Credit Strong App is a powerful tool for individuals seeking to improve their credit scores and achieve financial well-being. Through its comprehensive features and personalized recommendations, the app empowers users to take control of their credit and make informed decisions.

By utilizing the app's credit monitoring, identity theft protection, financial planning tools, and access to credit experts, users can effectively address negative items on their credit reports, reduce debt, and build a strong credit history. Credit Strong App's commitment to data security and privacy ensures that users' sensitive information remains protected.

As credit plays a pivotal role in various aspects of financial life, including loan approvals, interest rates, and insurance premiums, maintaining a good credit score is paramount. Credit Strong App provides users with the necessary resources and guidance to navigate the complexities of credit management and achieve their financial goals. By embracing the app's capabilities and following the recommended strategies, individuals can unlock the potential of their credit and secure a stronger financial future.

Unlocking Bridget's Legacy: Secrets Of Success Before 2019

Unlock The Secrets Of The Beloved "Tubbs Actor" In "Murder, She Wrote"

Unveiling Kali Rocha's Age: Secrets, Strengths, & Life Path Revealed

Credit Strong Review Can It Help Your Credit Score?

What Credit Score Do You Start With? Your Starting Credit In 2023

Should I get multiple installment accounts? Credit Strong

ncG1vNJzZmibmKSwrLjArWWsa16qwG7DxKyrZmpelrqixs6nmLCrXpi8rnvCq5ydoaRiwLW%2BzqeeZpmgpXupwMyl