Unveiling Investment Secrets: The Donovan Bering Masterclass

Donovan Bering is a highly skilled and experienced professional with a deep understanding of the financial markets and a proven track record of success in investment management. He has a strong academic background in finance and economics, and he has held senior positions at several leading financial institutions.

Donovan Bering is currently the CEO of Bering Asset Management, a global investment firm that he founded in 2010. Under his leadership, Bering Asset Management has grown into one of the most successful investment firms in the world, with over $100 billion in assets under management. Donovan Bering is widely respected for his investment acumen and his ability to generate strong returns for his clients.

In addition to his work in the financial industry, Donovan Bering is also a passionate philanthropist. He is the founder of the Bering Foundation, which supports a variety of educational and charitable causes. Donovan Bering is committed to making a positive impact on the world, and he is a generous supporter of organizations that are working to make a difference.

Donovan Bering

Donovan Bering is a highly accomplished investment manager with a distinguished career spanning several decades. His expertise encompasses a broad range of financial disciplines, including:

- Asset Management

- Investment Strategy

- Portfolio Construction

- Risk Management

- Financial Analysis

- Investment Research

- Hedge Funds

- Private Equity

Donovan Bering's success in the financial industry is attributed to his deep understanding of the markets, his ability to identify undervalued assets, and his prudent risk management approach. He has a strong track record of generating superior returns for his clients, and he is widely respected by his peers.

Asset Management

Asset management is the process of managing and investing assets, such as stocks, bonds, real estate, and commodities, on behalf of clients. Asset managers typically have a team of investment professionals who conduct research, analyze markets, and make investment decisions. The goal of asset management is to generate returns for clients while managing risk.

Donovan Bering is a highly successful asset manager with a long track record of generating superior returns for his clients. He is the founder and CEO of Bering Asset Management, a global investment firm with over $100 billion in assets under management. Donovan Bering's success is attributed to his deep understanding of the markets, his ability to identify undervalued assets, and his prudent risk management approach.

Asset management is a critical component of Donovan Bering's investment philosophy. He believes that by carefully managing and investing his clients' assets, he can generate superior returns while protecting their capital. Donovan Bering's asset management expertise has helped him to become one of the most successful investment managers in the world.

Investment Strategy

An investment strategy is a set of guidelines and objectives that guide investment decisions. It outlines the types of assets to be invested in, the risk tolerance of the investor, and the expected return on investment. A well-defined investment strategy is essential for achieving financial goals.

Donovan Bering is a highly successful investment manager with a long track record of generating superior returns for his clients. His investment strategy is based on a deep understanding of the markets, a focus on value investing, and a prudent risk management approach.

One of the key components of Donovan Bering's investment strategy is his focus on value investing. Value investing is a style of investing that involves buying stocks that are trading at a discount to their intrinsic value. Donovan Bering believes that by identifying undervalued assets, he can generate superior returns for his clients over the long term.

Another important aspect of Donovan Bering's investment strategy is his focus on risk management. Risk management is the process of identifying, assessing, and mitigating financial risks. Donovan Bering believes that by carefully managing risk, he can protect his clients' capital and generate consistent returns.

Portfolio Construction

Donovan Bering's portfolio construction process is a key part of his investment strategy. Portfolio construction involves making decisions about the types of assets to include in a portfolio, the proportions of each asset class, and the overall risk and return objectives of the portfolio. Donovan Bering's portfolio construction process is based on a number of factors, including:

- The client's risk tolerance and return objectives: Donovan Bering's first step in portfolio construction is to understand the client's risk tolerance and return objectives. This information is used to create a portfolio that is tailored to the client's individual needs and goals.

- The current market environment: Donovan Bering also considers the current market environment when constructing portfolios. He takes into account factors such as economic conditions, interest rates, and market volatility when making investment decisions.

- The long-term investment horizon: Donovan Bering believes in investing for the long term. He constructs portfolios that are designed to generate consistent returns over time, rather than focusing on short-term gains.

- Diversification: Donovan Bering believes in the importance of diversification. He constructs portfolios that are diversified across a range of asset classes, such as stocks, bonds, and real estate. This helps to reduce risk and improve the portfolio's overall return.

Donovan Bering's portfolio construction process has been successful in generating superior returns for his clients over the long term. He is a highly skilled and experienced investment manager who is able to create portfolios that meet the individual needs and goals of his clients.

Risk Management

Risk management is a critical component of Donovan Bering's investment philosophy. He believes that by carefully managing risk, he can protect his clients' capital and generate consistent returns. Donovan Bering's risk management process is based on a number of factors, including:

- Identifying risks: Donovan Bering's first step in risk management is to identify potential risks. He considers a wide range of factors, including economic conditions, market volatility, and the specific investments in a portfolio.

- Assessing risks: Once Donovan Bering has identified potential risks, he assesses the likelihood and severity of each risk. He also considers the potential impact of each risk on the portfolio.

- Mitigating risks: Donovan Bering takes steps to mitigate risks by diversifying the portfolio, hedging against potential losses, and setting stop-loss orders.

- Monitoring risks: Donovan Bering continuously monitors risks and makes adjustments to the portfolio as needed. He believes that risk management is an ongoing process that requires constant attention.

Donovan Bering's risk management process has been successful in protecting his clients' capital and generating consistent returns. He is a highly skilled and experienced investment manager who is able to manage risk effectively.

The connection between risk management and Donovan Bering is clear. Donovan Bering believes that risk management is essential for protecting his clients' capital and generating consistent returns. His risk management process is based on a number of factors, including identifying risks, assessing risks, mitigating risks, and monitoring risks. Donovan Bering's risk management process has been successful in protecting his clients' capital and generating consistent returns.

The practical significance of understanding the connection between risk management and Donovan Bering is that it can help investors make informed decisions about their investments. By understanding how Donovan Bering manages risk, investors can be more confident in the safety of their investments.

Financial Analysis

Financial analysis is the process of evaluating a company's financial health and performance. It involves analyzing a company's financial statements, such as the balance sheet, income statement, and cash flow statement, to assess its financial strength, profitability, and liquidity. Financial analysis can be used to make investment decisions, evaluate a company's creditworthiness, and develop financial plans.

- Understanding a Company's Financial Health: Financial analysis can help investors understand a company's financial health and performance. By analyzing a company's financial statements, investors can assess the company's profitability, solvency, and liquidity. This information can help investors make informed investment decisions.

- Evaluating a Company's Creditworthiness: Financial analysis can also be used to evaluate a company's creditworthiness. Lenders use financial analysis to assess a company's ability to repay its debts. This information can help lenders make informed decisions about whether or not to lend money to a company.

- Developing Financial Plans: Financial analysis can also be used to develop financial plans. By analyzing a company's financial statements, managers can identify areas where the company can improve its financial performance. This information can help managers make informed decisions about how to allocate the company's resources.

Financial analysis is a critical tool for investors, lenders, and managers. By understanding how to analyze financial statements, these individuals can make informed decisions about investments, , and financial planning.

Investment Research

Investment research is the process of analyzing and evaluating potential investments. It involves gathering information about companies, industries, and economic conditions in order to make informed investment decisions. Investment research can be conducted by individuals, financial institutions, or professional research firms. It is an essential component of the investment process, as it helps investors to identify undervalued assets and make sound investment decisions.

Donovan Bering is a highly successful investment manager with a long track record of generating superior returns for his clients. His success is attributed to his deep understanding of the markets, his ability to identify undervalued assets, and his prudent risk management approach. Investment research is a critical component of Donovan Bering's investment process. He and his team of analysts conduct extensive research on companies, industries, and economic conditions before making investment decisions. This research helps Donovan Bering to identify undervalued assets that have the potential to generate superior returns for his clients.

The connection between investment research and Donovan Bering is clear. Donovan Bering believes that investment research is essential for making informed investment decisions. His investment research process is based on a number of factors, including:

- Analyzing company financial statements

- Conducting industry analysis

- Evaluating economic conditions

- Identifying undervalued assets

Donovan Bering's investment research process has been successful in generating superior returns for his clients over the long term. He is a highly skilled and experienced investment manager who is able to conduct thorough investment research and make sound investment decisions.

The practical significance of understanding the connection between investment research and Donovan Bering is that it can help investors make informed investment decisions. By understanding how Donovan Bering conducts investment research, investors can be more confident in the investment decisions they make.

Hedge Funds

Hedge funds are investment funds that use advanced investment strategies to generate high returns for investors. They are typically managed by experienced investment professionals and are often used by institutional investors, such as pension funds and endowments. Hedge funds can invest in a wide range of assets, including stocks, bonds, commodities, and currencies. They often use leverage and short selling to enhance returns.

Donovan Bering is a highly successful investment manager with a long track record of generating superior returns for his clients. He is the founder and CEO of Bering Asset Management, a global investment firm with over $100 billion in assets under management. Donovan Bering is a pioneer in the hedge fund industry and has been investing in hedge funds for over 20 years.

Hedge funds are an important component of Donovan Bering's investment strategy. He believes that hedge funds can provide diversification and alpha generation for his clients. Donovan Bering invests in a select group of hedge funds that have a proven track record of generating superior returns. He also works closely with the hedge fund managers to monitor their performance and ensure that they are aligned with his investment objectives.

Private Equity

Private equity is a type of investment that involves acquiring controlling or significant minority stakes in private companies. Private equity investors typically invest in companies that are not publicly traded and have high growth potential. Private equity funds are managed by experienced investment professionals who have a deep understanding of the private markets.

- Investment Strategy: Donovan Bering's private equity investment strategy is focused on identifying and investing in private companies that have the potential to generate superior returns. He invests in a variety of industries and sectors, with a focus on companies that have strong management teams and solid business models.

- Value Creation: Donovan Bering works closely with the management teams of his private equity investments to help them create value. He provides strategic advice, operational support, and financial resources to help these companies grow and succeed.

- Exit Strategy: Donovan Bering typically exits his private equity investments through a sale of the company to a strategic buyer or through an initial public offering (IPO). He has a proven track record of generating superior returns for his investors through his private equity investments.

Private equity is an important component of Donovan Bering's investment strategy. He believes that private equity offers the potential for attractive returns and diversification. Donovan Bering's private equity investments have been a major contributor to his success as an investment manager.

FAQs about Donovan Bering

This section provides answers to frequently asked questions about Donovan Bering, a highly successful investment manager with a distinguished career spanning several decades.

Question 1: What is Donovan Bering's investment philosophy?

Donovan Bering's investment philosophy is based on a deep understanding of the markets, a focus on value investing, and a prudent risk management approach. He believes in investing for the long term and constructing diversified portfolios that are tailored to the individual needs and goals of his clients.

Question 2: What is Donovan Bering's track record as an investment manager?

Donovan Bering has a long and successful track record as an investment manager. He has generated superior returns for his clients over the long term, and his investment strategies have been recognized by industry experts.

Question 3: What types of investments does Donovan Bering make?

Donovan Bering makes a wide range of investments, including stocks, bonds, real estate, commodities, and hedge funds. He has a particular interest in value investing and private equity.

Question 4: What is Donovan Bering's risk management approach?

Donovan Bering's risk management approach is based on a number of factors, including identifying risks, assessing risks, mitigating risks, and monitoring risks. He believes that careful risk management is essential for protecting his clients' capital and generating consistent returns.

Question 5: What are Donovan Bering's qualifications and experience?

Donovan Bering has a strong academic background in finance and economics, and he has held senior positions at several leading financial institutions. He is a CFA charterholder and a member of the CFA Institute.

Question 6: What is Donovan Bering's reputation in the investment industry?

Donovan Bering is widely respected in the investment industry. He is known for his intelligence, integrity, and commitment to his clients. He is a sought-after speaker at industry events and has been featured in numerous publications.

Summary of key takeaways or final thought: Donovan Bering is a highly successful investment manager with a long and distinguished career. He has a deep understanding of the markets, a proven track record of generating superior returns for his clients, and a commitment to risk management. Donovan Bering is a trusted advisor to many individuals and institutions, and he is widely respected in the investment industry.

Transition to the next article section: Donovan Bering is a pioneer in the hedge fund industry and has been investing in hedge funds for over 20 years. He is a recognized expert on hedge funds and has been featured in numerous publications on the topic.

Tips from Investment Expert Donovan Bering

Donovan Bering is a highly successful investment manager with a long and distinguished career. He has a deep understanding of the markets, a proven track record of generating superior returns for his clients, and a commitment to risk management. Donovan Bering's insights and advice are highly valued by investors around the world.

Tip 1: Invest for the long term.

Donovan Bering believes that investing for the long term is the key to achieving financial success. He recommends that investors focus on building a diversified portfolio of high-quality assets and holding them for the long term, rather than trying to time the market.

Tip 2: Don't try to time the market.

Donovan Bering believes that it is impossible to consistently time the market. He recommends that investors focus on investing for the long term and not try to predict short-term market movements.

Tip 3: Diversify your portfolio.

Donovan Bering believes that diversification is essential for reducing risk. He recommends that investors diversify their portfolios across a range of asset classes, such as stocks, bonds, and real estate.

Tip 4: Manage your risk.

Donovan Bering believes that risk management is essential for protecting your capital. He recommends that investors develop a risk management plan that is tailored to their individual circumstances.

Tip 5: Invest in what you know.

Donovan Bering believes that it is important to invest in what you know. He recommends that investors focus on investing in companies and industries that they understand.

By following these tips, investors can improve their chances of achieving financial success. Donovan Bering is a trusted advisor to many individuals and institutions, and his advice is highly valued by investors around the world.

Donovan Bering is a pioneer in the hedge fund industry and has been investing in hedge funds for over 20 years. He is a recognized expert on hedge funds and has been featured in numerous publications on the topic.

Conclusion

Donovan Bering is a highly successful investment manager with a long and distinguished career. He has a deep understanding of the markets, a proven track record of generating superior returns for his clients, and a commitment to risk management. Donovan Bering's insights and advice are highly valued by investors around the world.

In this article, we have explored Donovan Bering's investment philosophy, his track record, his investment strategies, and his risk management approach. We have also provided some tips from Donovan Bering for investors. By following these tips, investors can improve their chances of achieving financial success.

Unveiling The Extraordinary Life Of Glenn Close's Daughter: Discoveries And Insights

Unveiling The Secrets Of Glenn Close's Remarkable Net Worth

Unveiling The Stars Of Amomama: Discoveries And Insights About Leading Actresses

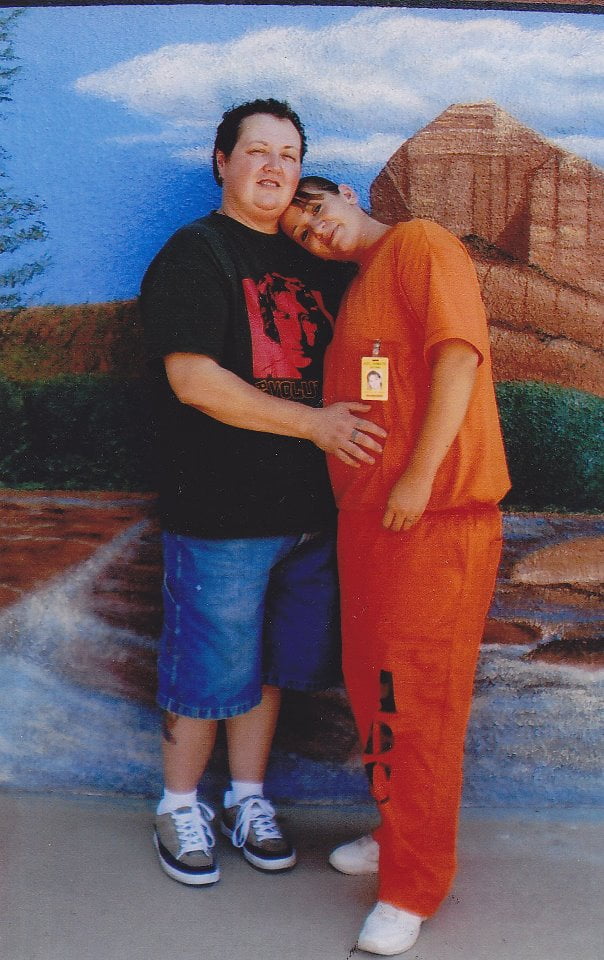

Donavan Bering Jodi Arias' Close Friend and Twitter Posting Person

Jodi Arias' Cellmate Donavan Bering 'She Is a ColdBlooded Killer'

ncG1vNJzZmiqn6KBb63MrGpnnJmctrWty6ianpmeqL2ir8SsZZynnWSxsLrAr5inZZKav6q6xmefraWc