Unveiling Callahan Walsh's Net Worth: Exclusive Insights Revealed

Callahan Walsh Net Worth refers to the total value of Callahan Walsh's assets and income. It is calculated by taking the value of all his assets, such as property, investments, and cash, and subtracting any liabilities or debts he may have.

Understanding a person's net worth can provide insights into their financial health, investment strategies, and overall wealth management. In the case of public figures like Callahan Walsh, their net worth can be of interest to the general public as it can indicate their success and financial standing. However, it's important to note that publicly available net worth figures may not always be accurate or up-to-date, and should be taken with a grain of salt.

Now let's explore the main article topics related to Callahan Walsh and his net worth.

Callahan Walsh Net Worth

Understanding Callahan Walsh's net worth involves examining various aspects of his financial standing. Key aspects to consider include:

- Assets: Properties, investments, cash

- Liabilities: Debts, loans

- Income: Earnings from salary, investments

- Expenses: Costs of living, taxes

- Investments: Stocks, bonds, real estate

- Savings: Cash reserves, retirement accounts

- Debt-to-income ratio: Percentage of income used to pay off debt

- Financial goals: Short-term and long-term financial aspirations

These aspects provide a comprehensive view of Callahan Walsh's financial health. By analyzing his assets, liabilities, income, and expenses, one can assess his ability to meet financial obligations, manage debt, and plan for the future. Understanding these aspects is crucial for making informed decisions regarding financial planning and investments.

Assets

Assets play a crucial role in determining Callahan Walsh's net worth. Properties, investments, and cash are key components of his overall financial standing. The value of these assets contributes directly to his net worth, which is calculated by subtracting any liabilities or debts from the total value of his assets.

Properties, such as real estate or land, can be a significant source of wealth. They can appreciate in value over time, providing a potential return on investment. Investments, such as stocks, bonds, or mutual funds, can also contribute to Callahan Walsh's net worth. The performance of these investments will impact the overall value of his assets.

Cash, including money in bank accounts and other liquid assets, provides Callahan Walsh with financial flexibility. It can be used to cover expenses, make investments, or pay off debts. The amount of cash he has on hand will affect his ability to meet short-term financial obligations and pursue financial goals.

Understanding the connection between assets and net worth is crucial for effective financial planning and management. By carefully managing his assets, Callahan Walsh can increase his net worth and improve his overall financial health.

Liabilities

Liabilities, such as debts and loans, play a crucial role in determining Callahan Walsh's net worth. Understanding the types and implications of his liabilities is essential for assessing his financial health and overall wealth.

- Outstanding Loans: Callahan Walsh may have outstanding loans, such as mortgages, personal loans, or business loans. These loans represent debts that he owes to financial institutions or other parties. The amount of outstanding loans he has will directly impact his net worth.

- Credit Card Debt: Credit card debt is a common form of liability. If Callahan Walsh carries a balance on his credit cards, this debt will be considered a liability. High credit card debt can negatively affect his credit score and overall financial standing.

- Taxes Payable: Callahan Walsh may have taxes payable, such as income tax, property tax, or sales tax. These taxes represent obligations to government entities and must be paid on time to avoid penalties and legal consequences. Unpaid taxes can accumulate and become a significant liability.

- Other Liabilities: In addition to the above, Callahan Walsh may have other liabilities, such as legal obligations, contractual commitments, or contingent liabilities. These liabilities can arise from various sources and can impact his financial health.

By carefully managing his liabilities, Callahan Walsh can improve his net worth and overall financial well-being. This may involve reducing debt, paying down credit card balances, and fulfilling tax obligations promptly. A solid understanding of his liabilities is essential for making informed financial decisions and achieving long-term financial success.

Income

Income plays a crucial role in determining Callahan Walsh's net worth. Income represents the earnings he receives from various sources, including salary, investments, and other income streams. Understanding the connection between income and net worth is essential for assessing his financial health and overall wealth.

Salary, which is the compensation received for his work, is a primary source of income for Callahan Walsh. The amount of salary he earns will directly impact his net worth. Higher salaries contribute to a higher net worth, assuming other factors remain constant. Additionally, Callahan Walsh may have other sources of income, such as dividends from investments or rental income from properties. These income streams can supplement his salary and further increase his net worth.

The practical significance of understanding the connection between income and net worth lies in its implications for financial planning and wealth management. By maximizing his income through career advancement, salary negotiations, or additional income streams, Callahan Walsh can increase his net worth and improve his overall financial well-being. Furthermore, he can make informed decisions about investments and savings based on his income levels and financial goals.

Expenses

Understanding the connection between expenses and Callahan Walsh's net worth is essential for assessing his financial situation. Expenses, which encompass costs of living and taxes, play a crucial role in determining his overall wealth.

Costs of living, such as housing, transportation, food, and healthcare, directly impact Callahan Walsh's net worth. Higher living expenses reduce his disposable income, which in turn limits his ability to save and invest. Conversely, lower living expenses allow him to allocate more of his income towards wealth-building activities.

Taxes, including income tax, property tax, and sales tax, also affect Callahan Walsh's net worth. Taxes reduce his after-tax income, which can impact his savings and investment decisions. Understanding the tax implications of his financial transactions is crucial for optimizing his net worth.

By carefully managing his expenses and tax obligations, Callahan Walsh can improve his net worth and overall financial health. This may involve negotiating lower living costs, exploring tax-advantaged investment options, or seeking professional financial advice to optimize his tax strategy.

Investments

Investments, encompassing stocks, bonds, and real estate, play a crucial role in determining Callahan Walsh's net worth. These investment vehicles represent a significant portion of his overall assets and contribute directly to his financial well-being.

Stocks, which represent ownership shares in publicly traded companies, offer the potential for capital appreciation and dividend income. Bonds, on the other hand, are fixed-income securities that provide regular interest payments and return the principal amount upon maturity. Real estate, including residential and commercial properties, can generate rental income and appreciate in value over time.

The performance of Callahan Walsh's investments directly impacts his net worth. Successful investments can lead to substantial gains, while underperforming investments can result in losses. Diversifying his investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk and potentially enhance returns.

Understanding the connection between investments and net worth is crucial for effective financial planning and wealth management. Callahan Walsh can make informed decisions about his investment portfolio by considering factors such as risk tolerance, investment goals, and time horizon. By carefully managing his investments, he can increase his net worth and secure his financial future.

Savings

Savings, encompassing cash reserves and retirement accounts, play a fundamental role in determining Callahan Walsh's net worth. These financial vehicles represent a critical component of his overall financial health and contribute directly to his long-term financial security.

- Cash Reserves: Cash reserves refer to liquid funds held in bank accounts, money market accounts, or other easily accessible locations. They provide Callahan Walsh with financial flexibility and serve as a buffer against unexpected expenses or emergencies. Maintaining a healthy level of cash reserves can help him avoid debt and maintain financial stability.

- Retirement Accounts: Retirement accounts, such as 401(k)s and IRAs, are long-term savings vehicles designed to accumulate funds for retirement. Contributions to these accounts are often tax-advantaged, allowing Callahan Walsh to reduce his current tax liability while saving for the future. The growth of these accounts over time can significantly contribute to his overall net worth.

The connection between savings and net worth is evident in the ability of savings to increase Callahan Walsh's financial resilience and provide a foundation for long-term wealth accumulation. By prioritizing savings and investing diligently, he can enhance his net worth and secure his financial future.

Debt-to-income ratio

The debt-to-income ratio (DTI) is a crucial financial metric that measures the percentage of an individual's monthly income that is allocated to debt repayment. Understanding the connection between DTI and Callahan Walsh's net worth is essential for assessing his financial health and overall wealth.

- Impact on Net Worth: A high DTI can negatively impact Callahan Walsh's net worth by limiting his ability to save and invest. When a significant portion of his income is dedicated to debt repayment, he has less disposable income available to allocate towards wealth-building activities.

- Creditworthiness: Lenders and creditors use DTI to assess the risk associated with lending money to Callahan Walsh. A high DTI can indicate that he may have difficulty managing his debt obligations, which can affect his credit score and access to favorable loan terms.

- Financial Stability: A low DTI indicates that Callahan Walsh has a greater capacity to manage his debt and meet his financial obligations. This provides him with financial stability and flexibility to handle unexpected expenses or emergencies.

- Long-Term Goals: A high DTI can hinder Callahan Walsh's ability to achieve his long-term financial goals, such as saving for retirement or purchasing a home. By reducing his DTI, he can free up more income for these important goals.

By maintaining a healthy DTI, Callahan Walsh can improve his financial well-being, increase his net worth, and secure his financial future. Managing debt effectively, reducing expenses, and increasing income can all contribute to lowering his DTI and enhancing his overall financial health.

Financial goals

Callahan Walsh's financial goals, both short-term and long-term, play a significant role in determining his overall net worth. Understanding the connection between his financial goals and net worth is essential for effective financial planning and wealth management.

- Short-Term Financial Goals: Short-term financial goals typically have a time horizon of less than five years and may include saving for a down payment on a house, building an emergency fund, or paying off high-interest debt. Achieving these goals can positively impact Callahan Walsh's net worth by increasing his savings and reducing his debt burden.

- Long-Term Financial Goals: Long-term financial goals typically have a time horizon of five years or more and may include saving for retirement, funding a child's education, or building a substantial investment portfolio. These goals require consistent saving and investing over time and can significantly contribute to Callahan Walsh's overall net worth.

By setting clear and achievable financial goals, Callahan Walsh can prioritize his saving and investment strategies to align with his long-term aspirations. This connection between financial goals and net worth highlights the importance of financial planning for building and maintaining wealth.

FAQs on Callahan Walsh Net Worth

This section addresses frequently asked questions surrounding Callahan Walsh's net worth, providing concise and informative answers.

Question 1: What factors contribute to Callahan Walsh's net worth?

Callahan Walsh's net worth is influenced by various factors, including his assets (e.g., properties, investments, cash), liabilities (e.g., debts, loans), income (e.g., salary, investments), and expenses (e.g., living costs, taxes).

Question 2: How does Callahan Walsh's income impact his net worth?

Income plays a crucial role in Callahan Walsh's net worth. Higher income allows him to save and invest more, contributing to the growth of his assets and overall net worth.

Question 3: What is the significance of investments in Callahan Walsh's net worth?

Investments, such as stocks, bonds, and real estate, are essential components of Callahan Walsh's net worth. Successful investments can lead to capital appreciation and generate additional income, boosting his overall financial standing.

Question 4: How do expenses affect Callahan Walsh's net worth?

Expenses, including living costs and taxes, reduce Callahan Walsh's disposable income. Managing expenses effectively allows him to allocate more funds towards savings and investments, ultimately contributing to his net worth.

Question 5: What role does debt play in Callahan Walsh's net worth?

Debt can negatively impact Callahan Walsh's net worth by reducing his disposable income and potentially leading to higher interest payments. Managing debt responsibly is crucial for maintaining a healthy financial position.

Question 6: How can Callahan Walsh increase his net worth?

Increasing income, minimizing expenses, investing wisely, and managing debt effectively are key strategies Callahan Walsh can employ to enhance his net worth.

In conclusion, Callahan Walsh's net worth is a reflection of his financial management decisions and overall wealth. Understanding the factors that influence his net worth empowers him to make informed choices and pursue strategies that align with his financial goals.

Proceed to the next section for further insights into Callahan Walsh's financial standing.

Tips for Understanding Callahan Walsh Net Worth

Evaluating Callahan Walsh's net worth involves analyzing various financial aspects and considering specific strategies to optimize his financial standing. Here are a few key tips to help you delve deeper into this topic:

Tip 1: Assess Assets and Liabilities

Begin by identifying Callahan Walsh's assets, including properties, investments, and cash, as well as his liabilities, such as debts and loans. This provides a comprehensive view of his financial resources and obligations.

Tip 2: Analyze Income and Expenses

Examine Callahan Walsh's income streams, including salary, investments, and any other sources. Additionally, consider his expenses, encompassing living costs, taxes, and other expenditures. Understanding his income and expenses helps determine his cash flow and financial flexibility.

Tip 3: Evaluate Investments and Savings

Review Callahan Walsh's investment portfolio, including stocks, bonds, and real estate. Assess the performance of these investments and their contribution to his overall net worth. Additionally, consider his savings habits and the effectiveness of his wealth accumulation strategies.

Tip 4: Calculate Debt-to-Income Ratio

Calculate Callahan Walsh's debt-to-income ratio to determine the percentage of his income that goes towards debt repayment. A high ratio can indicate potential financial strain and impact his ability to save and invest.

Tip 5: Consider Financial Goals

Identify Callahan Walsh's short-term and long-term financial goals. These goals, such as saving for retirement or purchasing a property, influence his financial decisions and the allocation of his resources.

Summary: By following these tips, you can gain a deeper understanding of Callahan Walsh's net worth and the factors that contribute to his financial well-being. Remember that net worth is a dynamic measure, and his financial situation may change over time based on various internal and external factors.

Proceed to the next section to delve into the intricate details of Callahan Walsh's financial standing.

Conclusion

The exploration of Callahan Walsh's net worth has shed light on the multifaceted nature of financial well-being. By analyzing his assets, liabilities, income, expenses, and financial goals, we gain insights into the factors that shape his overall wealth.

Understanding the dynamics of net worth empowers individuals to make informed financial decisions and pursue strategies that align with their long-term aspirations. Callahan Walsh's financial journey serves as a reminder that net worth is not merely a static measure but rather a reflection of ongoing financial management and adaptability to changing circumstances.

Unveiling Steve Howey's Family: Exclusive Insights Into His Precious Kids

Unveiling Annabella Sciorra's Journey: Insights And Discoveries

Unlocking The Secrets Of Denzel Washington's Sibling Legacy

Callahan Walsh Net Worth Digital Global Times

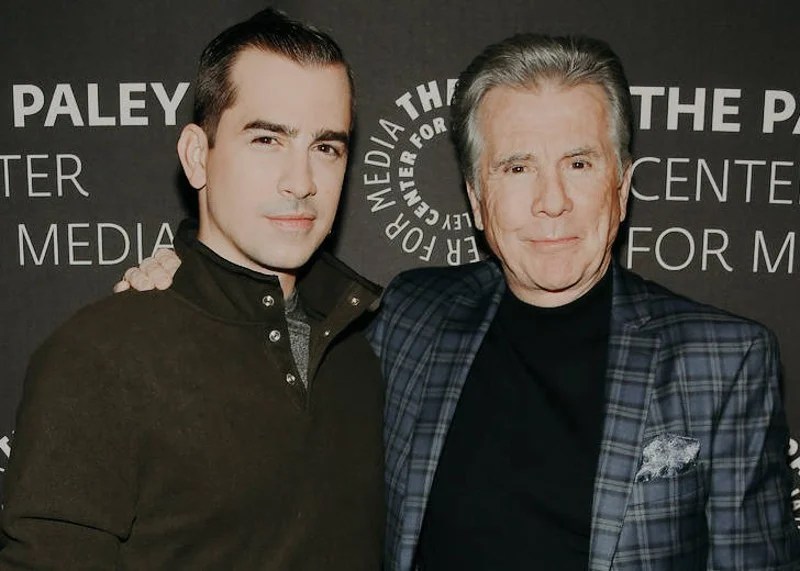

Callahan Walsh and John Walsh at the Critics' Choice Real TV Awards

ncG1vNJzZmialaC2r7OTZ5imq2NjsaqzyK2YpaeTmq6vv8%2Bamp6rXpi8rnvCmqOlmZiWu27DwKWqoWWemsFuw86rq6FmmKm6rQ%3D%3D